Empowering Brooklyn & NY Families to Ditch Overpriced Life Insurance.

You’re working hard, raising kids, and building a life. But if something happened to you tomorrow—would your family be financially secure?

I’m a licensed life insurance professional based in Brooklyn, NY. I specialize in helping married couples just like you make smarter, low-cost insurance decisions—without the pressure, confusion, or pushy sales tactics.

Get maximum protection, free up funds, and invest aggressively for your future.

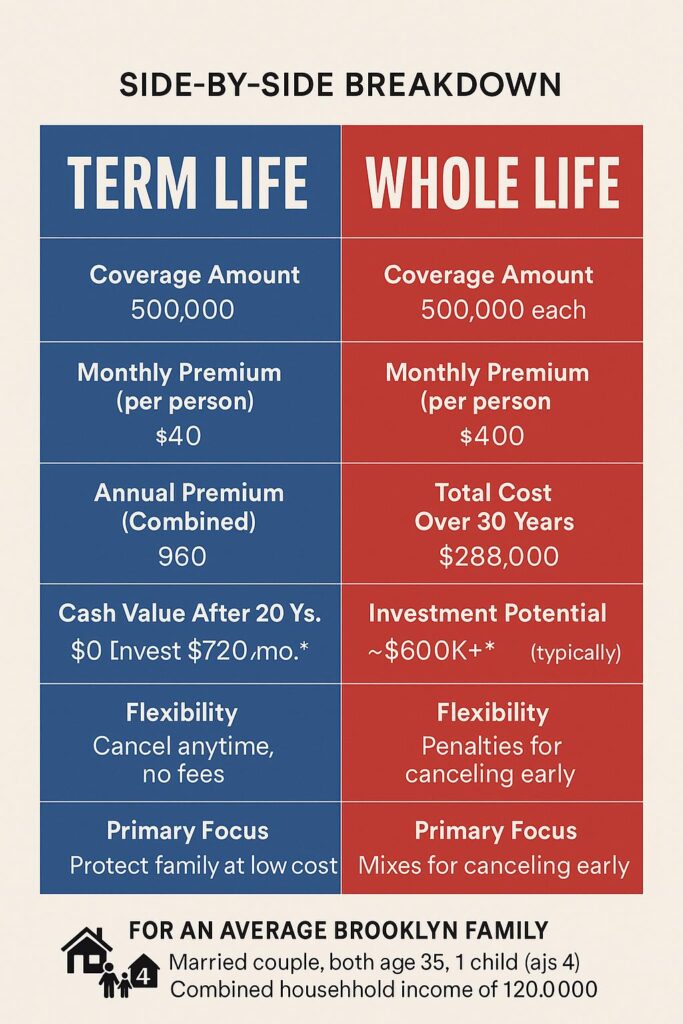

Why We Empower NY Families to Ditch Overpriced Insurance: The Power of Buying Term & Investing the Difference

Most families are sold expensive whole life insurance they don’t need. I take a different approach

Term insurance gives you maximum coverage for minimum cost

The money you would have spent on whole life? We show you how to invest that difference

You stay in control—of your future, your family’s safety net, and your long-

term goals

About Me

Your Partner for Smarter Life Insurance in Brooklyn & NY

I know what it feels like to work hard, earn a good income, and still wonder where all your money went.

My name is Arden C. Tannis, and for over 35 years, I balanced a demanding public service career with multiple income streams. I retired having earned a significant sum, but was stunned to realize my pension barely covered my mortgage. Daily expenses became a struggle, and I kept asking myself: Where did all the money go?

The painful truth was, I made the same mistake many hardworking families make. I focused on earning, but never truly learned how money actually works. I lacked the right kind of life insurance when it mattered most, never truly budgeted, and didn’t invest early or wisely. I was financially illiterate, and I paid the price.

That painful wake-up call became my turning point.

Our Mission: Empowering Your Family's Financial Future

I committed myself to comprehensive financial education, becoming both a licensed life insurance representative and a trained financial coach.

Now, I combine both roles to achieve a singular mission:

We empower Brooklyn and NY families to ditch overpriced life insurance, giving them maximum protection while freeing up funds to invest aggressively for their future.

At Term Life Specialist, I don’t just sell insurance. I sit down with busy, hard-working people like you – those feeling a little overwhelmed by finances – and explain the foundational basics no one taught us in school:

- Why term life insurance is often the smartest, most cost-effective option for young families.

- How to plan for the long term, even on a modest income.

- Practical strategies for budgeting, saving, and avoiding common financial traps.

- How to make informed financial decisions without feeling pressured or confused.

Why This Matters for You

If you’re starting a family, paying off debt, buying your first home, or just want to stop feeling lost when it comes to money, I understand. I’ve walked that path. Now, I make it my purpose to help you feel confident, protected, and fully in control of your financial life.

My approach is simple:

- No jargon

- No pushy sales tactics

- Just clear, honest conversations – at your pace, whether at your kitchen table or online.

Let’s build the solid financial foundation you and your family need to thrive, not just survive.

Ready to Build Your Financial House the Right Way?

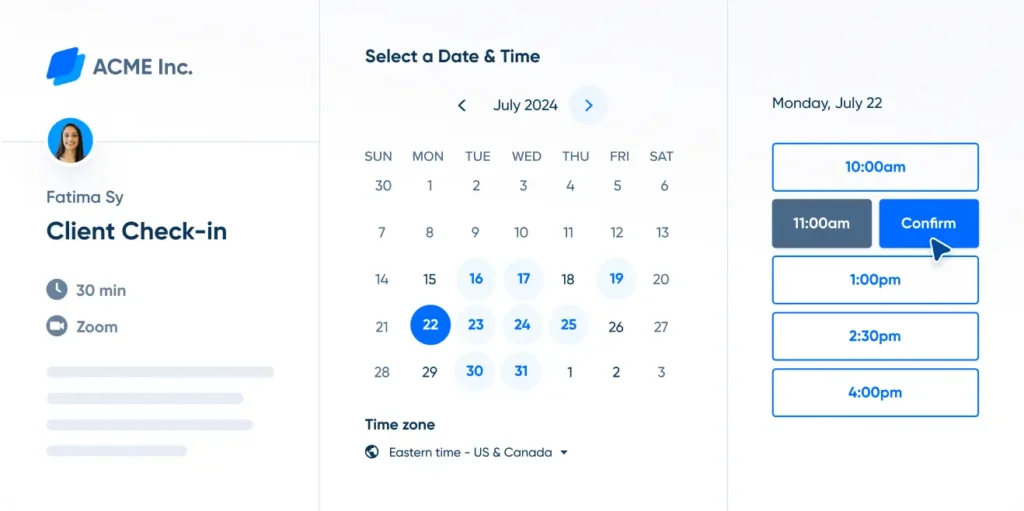

📞 Book your free 15-minute consultation today. Let’s discuss smarter protection and how to unlock more funds for your future.

Free Guide

Term vs. Whole Life: What No One Explains (But You Need to Know)

Download this quick, clear guide and find out why buying term and investing the

difference could save you thousands.

Want to see what your options look like—without any pressure?

Let’s chat privately about:

- How much coverage your family actually needs

- How to avoid overpaying

- Simple ways to invest the difference

What Client Says!

“We didn’t know much about life insurance, but Mr. Arden C. Tannis explained

everything in plain language. He helped us protect our kids and start investing without

breaking our budget.”

Rated 5 out of 5

— Mr & Ms Marshall; Brooklyn, NY

“It felt sitting at our kitchen table with someone who genuinely cared—not a

salesperson.”

Rated 5 out of 5

— Sarah, Queens, NY

Frequently Asked Questions (FAQ)

Navigating the world of life insurance can feel complex, but at TermLifeSpecialist.biz, we be-

lieve in clear, honest, and empowering information. Here are answers to common questions

our clients ask, designed to build your confidence and help you make informed decisions

about your family’s financial future.

Understanding Term Life Insurance

TermLifeSpecialist.biz: That’s a great place to start! Term life insurance provides financial

protection for your loved ones for a specific period, or “term,” typically 10, 20, or 30 years. If

you pass away within this term, your beneficiaries receive a tax-free death benefit payout.

This money can be used to replace your income, cover mortgage payments, fund children’s

education, pay off debts, or support daily living expenses. It’s a straightforward and affordable

way to ensure your family’s financial stability and peace of mind, even when you’re no longer

there.

Why Choose Term Life?

TermLifeSpecialist.biz: Term life insurance is often the most cost-effective option for sub-

stantial coverage during your peak earning years and when family responsibilities are highest.

Unlike permanent policies, like whole life, term insurance focuses solely on providing a death

benefit without a savings component. This makes premiums significantly lower, allowing you

to get maximum coverage for your budget. This ensures critical financial needs are met

during the period they’re most crucial. Our specialists can help you determine if term life is the

ideal fit for your unique situation.

Determining Your Coverage Needs

TermLifeSpecialist.biz: Determining the right amount of life insurance coverage is crucial.

We recommend considering factors like your annual income, outstanding debts (mortgage,

loans, credit cards), future expenses (college tuition, childcare), and your family’s ongoing

living costs. A common guideline is 10-15 times your annual income, but remember, your

needs are unique. You can use our easy-to-use coverage calculator or speak with one of

our experienced Term Life Specialists for a personalized assessment to ensure your loved

ones are adequately protected.

Getting a Quote and Understanding Premiums

TermLifeSpecialist.biz: Our online quote tool provides instant, estimated quotes based on

basic information like age, gender, and health. While convenient, these are estimates. Your fi-

nal personalized premium is determined by a comprehensive underwriting process that con-

siders your full health history, lifestyle (e.g., smoking habits, risky hobbies), family health his-

tory, and even your driving record. We work with top-rated insurance carriers to ensure you

receive the most competitive and accurate rates available.

Client: Is a medical exam required for term life insurance, and how does it impact my applica- tion?

TermLifeSpecialist.biz: Many term life policies, especially for higher coverage amounts, re-

quire a quick and free medical exam. This helps insurance companies accurately assess

your health risk, which can lead to lower premiums if you’re in good health. For those who

prefer to avoid an exam or have certain health conditions, we also offer no-medical-exam

options with simplified underwriting processes, providing flexibility and convenience without

compromising on vital coverage.

Policy Management and Future Options

TermLifeSpecialist.biz: Once your term life insurance policy is issued and your premiums

are locked in, your health status typically does not affect your existing policy rates. This

provides long-term rate stability and peace of mind. However, if you decide to apply for a new

policy or increase your coverage in the future, your current health will be reassessed. We en-

courage you to review your policy periodically to ensure it continues to meet your evolving

needs.

TermLifeSpecialist.biz: Yes, most term life insurance policies offer options for renewal or

conversion. You can typically renew your policy for another term, though premiums will be

recalculated based on your age at renewal. Alternatively, many policies allow you to convert

to a permanent life insurance policy (like whole life) without a new medical exam, providing

lifelong coverage regardless of your current health. Our Term Life Specialists can help you

understand these options and plan for the future.

The Application Process

TermLifeSpecialist.biz: Our streamlined application process is designed for efficiency. Af-

ter getting an initial quote, you’ll complete a more detailed application, which may include a

phone interview and a medical exam (if applicable). We handle all the paperwork and commu-

nication with the insurance carrier on your behalf. The time to get approved coverage can

vary, but we work diligently to expedite the process, often securing policies within a few

weeks, so you can have peace of mind sooner.

Why Choose TermLifeSpecialist.biz?

TermLifeSpecialist.biz: At TermLifeSpecialist.biz, we partner with Primerica, a reputable,

highly-rated insurance company that exclusively specializes in term life insurance. This

means we can offer more options, policy features, coverage, and value. Our goal is to provide

expert advice and guide you through a transparent process, ensuring your family’s financial

security is our top priority.

Still Have Questions?

TermLifeSpecialist.biz: We understand that life insurance decisions are significant. Our

team of dedicated Term Life Specialists is here to provide personalized guidance and an-

swer all your questions. We are committed to empowering you with the knowledge you need

to protect your family’s future. Don’t hesitate to contact us directly via phone, email, or our

online form for a no-obligation consultation. We’re here to help you secure the right coverage

with confidence.